1. FTA overview

Globalization and trade liberalization are not only the most important incentive to drive the economy in the XXI century but also an inevitable tendency for the progress of production specialization and the distribution of the labour force. The incentive trade links via the bilateral and multilateral Free Trade Agreements (FTAs) are powerful motivation, attracting the attention and participation of many countries and Vietnam is no exception. Since the first FTA was signed, the number of FTAs is quickly increasing. This triggers the smooth flow of goods to move across boundaries and spaces between different countries.

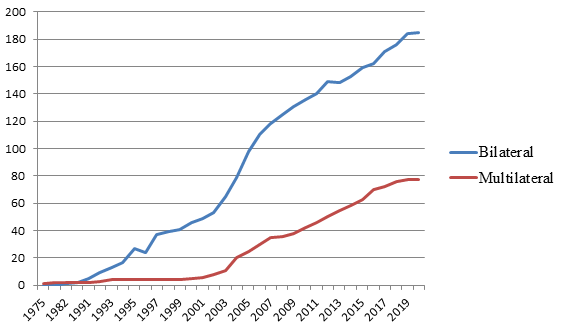

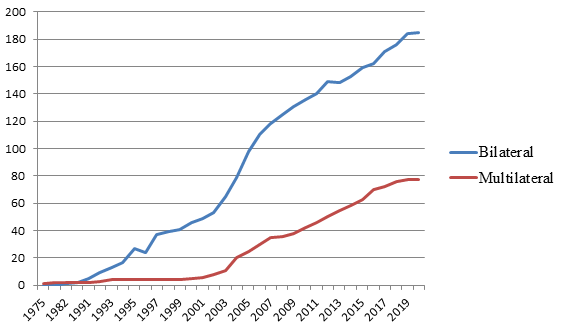

The level of integration is expressed from bilateral and multilateral cooperation to global cooperation. As of 2020, there are 185 bilateral agreements and 77 multilateral agreements in the world. According to statistics of Asia Regional Integration Center, in the period 1960 to 2016, world trade increased by about 3.5% per year and the proportion of the world’s gross domestic product (GDP) rose from 24% to 56%.

Numbers of bilateral and multilateral Free Trade Agreements in the world by the end of 2018

Vietnam is a country with a high level of international economic integration. This is a result of the active participation and negotiation of Free Trade Agreements (FTAs) with other countries in the world, especially new-generation FTAs which are negotiated and signed in recent times, containing large scope and high level of liberalization.

As of June 2020, Vietnam officially joined 13 FTAs (including 7 FTAs signed as a member of ASEAN and 6 FTAs signed as an independent party), in addition, Vietnam is negotiating 3 FTAs. The total number of Vietnam’s trading partners in FTAs is 56 economies, including 55 countries and 1 territory. Vietnam’s signing of bilateral and multilateral FTAs has enabled Vietnamese enterprises to expand their markets, gaining access to regional and global markets.

Vietnam’s Integration Process into the International Economy

(Including FTA negotiations, participation within ASEAN, and other cooperation)

|

Year

|

Description

|

|

1986

|

Start of economic renovation toward “socialist-oriented market economy”, transfer into a market economy

|

|

1995

|

Became an official member of ASEAN

|

|

1996

|

Participated in the Common Effective Preferential Tariff Scheme within the ASEAN Free Trade Agreement scope.

Became a founding member of the Asia-Europe Meeting

|

|

1998

|

Became an official member of the Asia-Pacific Economic Corporation (APEC)

|

|

2002

|

Started FTA negotiation with China of ASEAN-China Free Trade Area (ACFTA) (As a member of ASEAN)

|

|

2003

|

Started FTA negotiation with Japan of ASEAN-Japan Comprehensive Economic Partnership (AJCEP) (As a member of ASEAN)

Started FTA negotiation with India of ASEAN-India Free Trade Area (AIFTA) (As a member of ASEAN)

|

|

2005

|

Started FTA negotiation with Australia and New Zealand of ASEAN-Australia-New Zealand Free Trade Area (AANZ FTA) and Korea of ASEAN-Korea Free Trade Area (AKFTA) (As a member of ASEAN)

|

|

2006

|

Admitted to World Trade Organization (WTO)

|

|

2007

|

Completed FTA negotiation with Korea of ASEAN-Korea Free Trade Agreement (AKFTA) (commenced in July 2007)

|

|

2008

|

Completed negotiation with Japan of ASEAN-Japan Comprehensive Economic Partnership (AJCEP) (commenced in December 2008)

Started bilateral FTA negotiation with Chile of Vietnam-Chile Free Trade Agreement (VCFTA)

|

|

2009

|

Completed FTA negotiation with Australia and New Zealand of ASEAN-Australia-New Zealand Free Trade Area (AANZ FTA) (commenced in January 2010)

Completed FTA negotiation with India of ASEAN-India Free Trade Area (AIFTA) (commenced in June 2010)

|

|

2010

|

Started negotiation with Japan of Vietnam-Japan Economic Partnership Agreement (VJEPA)

Started negotiation with Brunei, Chile, New Zealand, Singapore, Australia, Malaysia, Peru, America, Japan, Canada, Mexico of Trans-Pacific Strategic Economic Partnership Agreement (TPP)

|

|

2011

|

Completed FTA negotiation with Chile of Vietnam-Chile Free Trade Agreement (VCFTA) (commenced in January 2014)

|

|

2012

|

Started FTA negotiation with Korea of Vietnam-Korea Free Trade Agreement (VKFTA)

Started FTA negotiation with Australia, China, Japan, Korea, New Zealand of Regional Comprehensive Economic Partnership (RCEP) (As a member of ASEAN)

Started FTA negotiation with European Free Trade Association (EFTA)

Started FTA negotiation with Europe of Europe-Vietnam Free Trade Agreement (EVFTA)

|

|

2013

|

Started FTA negotiation with Armenia, Belarus, Kazakhstan, Nga, and Kyrgyzstan of Vietnam-Eurasian Economic Union Free Trade Agreement (VN – EAEU FTA)

|

|

2014

|

Started FTA negotiation with Hong Kong of ASEAN-Hong Kong, China Free Trade Agreement (AHKFTA) (As a member of ASEAN)

Completed negotiation with Armenia, Belarus, Kazakhstan, Nga, and Kyrgyzstan of Vietnam-Eurasian Economic Union Free Trade Agreement (VN – EAEU FTA) (commenced in October 2016)

|

|

2015

|

Signed Free Trade Agreement with Korea (commenced in December 2015)

Completed negotiation of Vietnam-Europe about Europe-Vietnam Free Trade Agreement (commenced in August 2020)

Started FTA negotiation with Israel

|

|

2017

|

Completed FTA negotiation with Hong Kong of ASEAN-Hong Kong, China Free Trade Agreement (AHKFTA) (As a member of ASEAN) (commenced in June 2019)

|

|

2018

|

Signed Comprehensive and Progressive Agreement for Trans-Pacific Partnership (commenced in January 2019)

|

|

2019

|

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) came into effective

|

|

2020

|

Europe-Vietnam Free Trade Agreement (EVFTA) comes into effective

|

Vietnam FTAs

| Full name of FTAs |

Abbreviation |

| ASEAN Free Trade Area |

(AFTA) |

| ASEAN-China Free Trade Area |

(ACFTA) |

| ASEAN-Korea Free Trade Area |

(AKFTA) |

| ASEAN-Japan Comprehensive Economic Partnership |

(AJCEP) |

| Vietnam-Japan Economic Partnership Agreement |

(VJEPA) |

| ASEAN-India Free Trade Area |

(AIFTA) |

| ASEAN-Australia-New Zealand Free Trade Area |

(AANZFTA) |

| Vietnam-Chile Free Trade Agreement |

(VCFTA) |

| Vietnam-Korea Free Trade Agreement |

(VKFTA) |

| Vietnam-Eurasian Economic Union Free Trade Agreement |

(VN – EAEU FTA) |

| Comprehensive and Progressive Agreement for Trans-Pacific Partnership |

(CPTPP) |

| ASEAN-Hong Kong, China Free Trade Agreement |

(AHKFTA) |

FTA approved and will come into effect on August 1st, 2020

| Full name of FTAs |

Abbreviation |

| Europe-Vietnam Free Trade Agreement |

(EVFTA) |

In Negotiation

| Full name of FTAs |

Abbreviation |

| Regional Comprehensive Economic Partnership |

(RCEP) |

| Vietnam - European Free Trade Association |

(Vietnam – EFTA) |

| Vietnam – Israel Free Trade Agreement |

(Vietnam – Israel FTA) |

Vietnam has been a member of ASEAN in July 1995. This has opened the new era of the international economic integration of the country. Since then, Vietnam has joined 13 Free Trade Agreements, as well as negotiating 3 new-generation Free Trade Agreements with not only foreign countries but also territories in the world. AFTA, a multilateral Free Trade Agreement among ASEAN countries, is the first agreement Vietnam joined. Since it took effect in 1993, Vietnam has continuously joined several FTAs both bilateral and multilateral agreements.

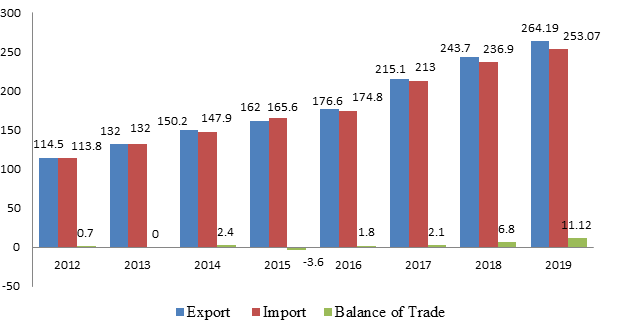

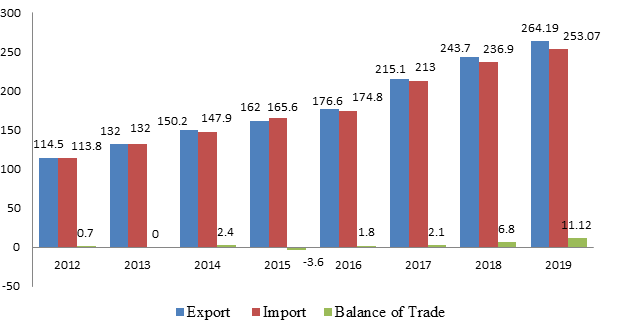

FTA has important contributions toward Vietnam’s export turnover. In 2007, the total import-export turnover was 111.3 billion dollars (in which export turnover was 48.5 billion dollars and import turnover was 62.7 billion dollars). In 2015, the total import-export turnover increased about 3 times, achieving 328 billion dollars (in which export turnover was 165.6 billion dollars and import turnover was 162.4 billion dollars). In 2019, the total import-export turnover reached 517.26 billion dollars (in which export turnover was 264.19 billion dollars and import turnover was 253.07 billion dollars).

Besides, FTAs have positive improvements in attracting foreign investment into Vietnam, especially CPTPP and EVFTA, those large markets provide a great deal of capital to the country. In 2006, FDI disbursement only reached 5 billion dollars. In 2019, those break a record with 20.38 billion dollars, increasing 6.7% compared to the same period in 2018. FDI projects have contributed nearly 20% of GDP. This result is an important incentive for developing the country. In addition, FTAs play an important role in promoting growth, economic transition, improving spiritual and material life for Vietnamese society. Along with that, per capita income has improved considerably compared to what it was. GDP increases from 730 dollars in 2006 to 2.786 dollars in 2019, rising about 3.6 times. The poverty rate plummeted from over 70% to 6%. Although Vietnam has harnessed integration opportunities to expand the export scale, accessing international markets, however, the ratio of export to GDP indicates that Vietnam’s economy depends on the world market. This imposes risks on market stability when the world must face the economic crisis.

Moreover, FTAs help to enhance the business environment and institution, hence, Vietnam has opportunities to restructure toward the import-export system more balanced. Thanks to FTA, Vietnam has motivations to improve the investment environment, carrying on business toward transparency, safety for investors of all economic sectors.

Vietnam’s import and export turnover, Balance of Trade in the period of 2012 to 2019

Source: General Department of Vietnam Customs

In 2019, the average tax rate of tariff lines committed to reduce and fluctuate between 0.07% to 9.1%, of which the lowest tax rate is ASEAN (0.07%) and the highest is CPTPP (9.1%). To 2022, the average of tariff lines committed will decrease, fluctuating between 0.04% and 4.8%.

As a result of reducing tax through FTAs, Vietnam's export has gained many achievements in recent years. Due to the effectiveness of several new-generation FTAs, Vietnam's export goods have better edge competitive since tariff barriers are gradually removed. In 2019, Vietnam's export turnover increased 8% compared with one in 2018. The EU is a potential market and Vietnam's major trading partners. When EVFTA is officially effective on August 1st, 2020, the exported proportion of Vietnam to the European market will sharply rise. Up to 70% of Vietnam's goods will be decreased and the EU will commit reduction for import tax of 99.7% of tariff lines which is equivalent to 99.7% of Vietnam's exports to the EU. Trade transactions increased rapidly from 2000 to 2018, in which goods export increased rapidly (about 10 times), from 2.3 billion dollars to 13.89 billion dollars.

In the first quarter, although the global economy is affected by the Covid-19 pandemic, export goods to our main export market such as America, China, Japan,...still rise. Specifically, America was Vietnam's largest export market with export turnover reaching 24.6 billion dollars, increasing 8.2% in comparison with the same period last year. To come to China, export turnover reached 16.3 billion dollars, increasing 20.1%. Regarding Japan, it reached 8.1 billion dollars, increasing 2.2%.

2. Key FTAs: AFTA, CPTPP AND EVFTA

Among FTA that Vietnam has joined, AFTA, CPTPP and EVFTA are considered the most important agreements due to its influence on Vietnam’s economy and business environment. ASEAN was attracting a large investment capital when Vietnam joined in the AFTA, therefore, it has created many possible opportunities to industrialize and modernize the country. Meanwhile, CPTPP is considered a high-quality FTA, with the deepest level of commitment ever. CPTPP member countries constitute a huge market containing 500 million people, holding approximately 15% of GDP, accounting for about 15% of total global trade. It also pushes Vietnam’s export goods to big countries on 3 continents: Asia, America and Oceania. Regarding EVFTA, the commitments of tax and investments in this agreement help Vietnam to renovate the economic structure, improving the local business environment. All of these FTAs provide favorable conditions for the growing economy in Vietnam.

2.1. ASEAN Free Trade Area (AFTA)

ASEAN Free Trade Area (AFTA) is a multilateral free trade area among countries in the ASEAN area. Purpose of AFTA is to enhance ASEAN's comparative capability, contemporaneously encourage the attractiveness of the foreign direct investment. The road map is to gradually reduce tariffs to 0-5%, eliminating tariffs barriers of some commodity groups and remove non-tariff barriers, harmonizing procedures of member counties in AFTA. The key mechanism for carrying out AFTA is Common Effective Preferential Tariff (CEPT).

The initiative to form AFTA was rooted in Thailand. Subsequently, this agreement was signed in 1992. Initially, there are only six countries which are Brunei, Indonesia, Malaysia, Philippines, Singapore and Thailand (the general name is ASEAN-6). Cambodia, Laos, Myanmar and Vietnam (the general name is CLMV) were required participating in this group.

CEPT sketched out a detailed mechanism intending to reduce tariffs. The first stage was started on 1st January 1993, all Member States complied with the reduction from existing tariff rates to 20%. This stage would be done within a time frame of 5 years to 8 years, which depended on the intention of each Member State. Countries were encouraged to adopt an annual rate reduction. In the second stage, tariff rates would be reduced from 20% or below within a time frame of 7 years. The rate of reduction shall be at a minimum of 5% quantum per reduction.

With the achievements of reduction tariffs because of the implementation of AFTA and CEPT, ASEAN Trade in Goods Agreement (ATIGA) signed in February 2009 and has effectiveness on May 17th, 2010. According to ATIGA, ASEAN countries would completely eliminate tariff barriers basing on the road map for ASEAN-6 countries, 99.2% of tariff lines have been removed, whereas 90.0% of tariff lines of acceding countries including Cambodia, Laos, Myanmar and Vietnam were eliminated since 2017. In 2018, the tariff elimination rate in the whole ASEAN area reached more 98.6%. For Vietnam, since January 1st, 2018, an addition (7%) tariff lines were reduced to 0%. This leads to an increase in the sum of tariff lines from ASEAN to Vietnam (97%).

2.2. Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTTP)

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTTP) is a new-generation free trade agreement, containing 11 countries: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. The agreement was signed on March 8th, 2018. For Vietnam, it has been effective since January 14th, 2019. This agreement adjusts many fields, from traditional commerce to some little traditional issues as government procurement, e-commerce, or expanding some non-traditional issues as labor, environment, anti-corruption in trade and investment. The CPTTP is considered a high quality and comprehensive FTA with the deepest commitment level from the past up to now.

After 1 year since the CPTPP agreement has been effective, in 2019, trade exchange turnover between Vietnam and Member State in CPTPP reached 77.4 billion-dollar, increasing 3.9% compared with those in 2018. Export from Vietnam to member countries in CPTPP reached 39.5 billion dollars, rising 7.2% compared with those in 2018. Remarkably, some markets as Canada and Mexico which Vietnam did not set up trade relations in the time before noted a sharp increase when CPTPP took effect. Therefore, in 2020, Vietnam had export surplus products to CPTPP member countries about 1.6 billion dollars. Earlier, in 2018, Vietnam had import surplus from those about 0.9 billion dollars.

The commitment of import tax of CPTPP countries to Vietnam

|

Immediately |

After 4 years |

After 7 years |

After 8 years |

After 10 years |

After 11 years |

After 16 years |

After 17 years |

| Australia |

93% |

100% |

|

|

|

|

|

|

| Brunei |

92% |

|

99.9% |

|

|

100% |

|

|

| Canada |

94.9% |

96.3% |

|

|

|

|

|

|

| Chile |

95.1% |

|

|

99.9% |

|

|

|

|

| Malaysia |

84.7% |

|

|

|

|

99.9% |

|

|

| Mexico |

77.2% |

|

|

|

98% |

|

|

|

| New Zealand |

94.6% |

|

100% |

|

|

|

|

|

| Japan |

86% |

|

|

|

|

95.6% |

|

|

| Peru |

80.7% |

|

|

|

|

|

|

99.4% |

| Singapore |

100% |

|

|

|

|

|

|

|

CPTPP paves the way for economic growth. Base on the favorable result which CPTPP brought Vietnam during 1 year Vietnam has been a membership of CPTPP, CPTPP will help Vietnam’s GDP increase 4.7% in 2035 compared with those in 2017. Vietnam’s export turnover will have an average increase of 4.32% per year and the export market will be diversities. The total export turnover will reach 311.1 billion dollars in 2030, compared to 179.5 billion dollars in 2017. Moreover, CPTPP is expected to breed 20000 to 26000 works per year.

2.3. Europe-Vietnam Free Trade Agreement (EVFTA)

Europe-Vietnam Free Trade Agreement (EVFTA) is a new-generation free trade agreement, which is signed between Vietnam and 27 individual EU members. EVFTA and CPTPP are the largest commitment and highest commitment level of Free Trade Agreements.

On December 1st, 2015, EVFTA officially ends negotiation and on February 1st, 2016, the agreement document was announced. On June 26th, 2018, two parts unanimously approved, accordingly, EVFTA was separated two agreements: Europe-Vietnam Free Trade Agreement (EVFTA). Two agreements were signed on June 30th, 2019. On February 12nd 2020, the European Parliament approved EVFTA and EVIPA. On June 8th, 2020, Vietnam National Assembly approved these agreements. Therefore, they will be officially effective on August 1st, 2020.

The implement of EVFTA will make a breakthrough in imports and export between Vietnam and the EU. The agreement will boost exportation, commerce activities, foreign direct investment and the state budget. Specifically, experts estimate that the average of Vietnam exports to EU will rise from 4.36% to 7.27% for the first 5-year implementation period, from 10.63% to 15.4% for the subsequent 5-year implementation period and from 16.41% to 21.66% for the final 5-year implementation period.

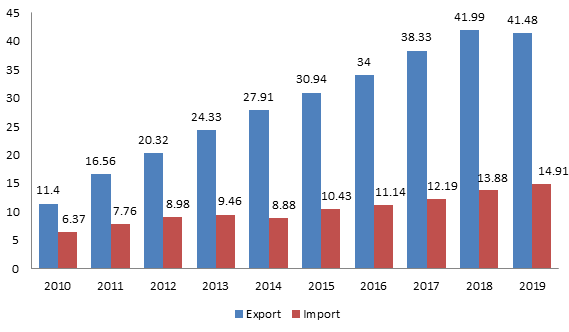

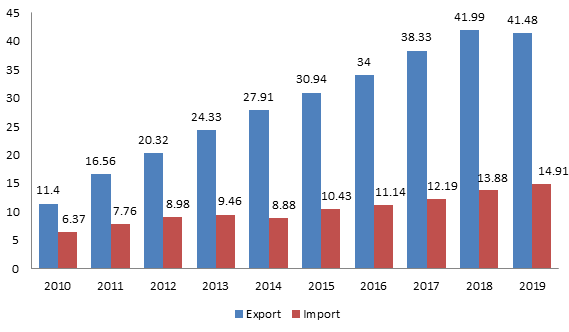

Export and export turnover between Vietnam and EU from 2010 to 2019

This agreement was signed to address the demands of both parties. EU is a section occupying the large proportion of commercial relationships between Vietnam and the EU. This relationship rapidly and effectively developed, from 2000 to 2017, Vietnam-EU trade relation turnover increased more than 13.8 times, from 4.1 billion dollars in 2000 to 56.39 billion dollars in 2019, in which exports from Vietnam to EU soared 14.8 times (from 2.8 billion dollars to 41.48 billion dollars) and import from EU to Vietnam rose more than 11.5 times (from 1.3 billion dollars to 14.91 billion dollars).

With EVFTA, Vietnam will deepen its relationship with the global economy, Vietnamese goods and services to the global value chains, pushing economic growth.

Vietnam-EU FTA Signs of Progress

|

Year

|

Description

|

|

The stage before October 2012

|

Both parties carried out technical activities to prepare for negotiations

|

|

June 2012

|

Both parties declared the launch of negotiations

|

|

From October 2012 to August 2015

|

Both parties implemented 14 official negotiation rounds and many midterm negotiation sessions

|

|

August 4th, 2015

|

Both parties announced the end of basic negotiations

|

|

December 1st, 2015

|

Both parties proclaimed the end of DVFTA negotiations

|

|

February 1st, 2016

|

Both parties launched the official document of EVFTA

|

|

June 2017

|

Both parties completed for legal review at the technical level

|

|

June 26th, 2018

|

Both parties agreed with dividing EVFTA into two Agreements: Commercial Agreement (EVFTA) and Investment Protection Agreement (EVIPA), ending the legal review process of EVFTA officially

|

|

August 2018

|

Both parties officially completed the legal review of EVFTA

|

|

October 17th, 2018

|

European Commission officially approved EVFTA and EVIPA

|

|

June 30th, 2019

|

Both parties officially signed EVFTA and EVIPA

|

|

December 12nd, 2020

|

European Parliament officially approved EVFTA and EVIPA

|

|

June 8th, 2020

|

Vietnam National Assembly officially approved EVFTA and EVIPA

|

|

August 1st, 2020

|

EVFTA come into effective

|

In conclusion, Free Trade Agreements are the key for Vietnam to connect the global trade network. Since Vietnam access the global trade system, with FTAs, the Vietnamese economy has acquired outstanding achievements. It has enhanced the country’s position in global value chains through new business and investment opportunities, facilitating stable and sustainable development. New-generation FTAs breed a lot of benefits to member States, attracting investment capital, improving administrative institutions and business environment. Nevertheless, it is a challenge to successfully implement the FTAs, as well as deploy the commitments that Vietnam has made. It’s safe to say that it requires comprehensive changes from public and private entities in order to ensure commitments that help the nation’s development.

*****

Please contact us for any further concerns related to the topic of this article.

About Us

Asia Business Consulting is a boutique consulting firm specializing in corporate establishment, legal and business advisory, tax and payroll compliance, HR administration, market research to multinationals investing in Vietnam. For further information or to contact the firm, please email This email address is being protected from spambots. You need JavaScript enabled to view it. or download the company brochure. You can stay up to date with the latest business and investment news in Vietnam by subscribing to our newsletters.